BENEFIT LIMITS

For some members, the Internal Revenue Code (IRC) Sections 401(a) (17) and 415(b) may put a cap on the amount the Plans may pay you in retirement benefits.

IRC 401(a) (17) Compensation Limits

Generally, IRC 401(a) (17) limits the amount of compensation that may be used to calculate a retirement benefit. The limit is adjusted annually; the maximum annual compensation that can be used to calculate your retirement benefit for 2025 is $350,000. If you earned more than that amount in your annual compensation, we will not be able to include the excess in calculating your benefit.

If you first became a FCERS or PF Plan member before January 1, 1996, the IRC 401(a) (17) compensation limit does not apply to you.

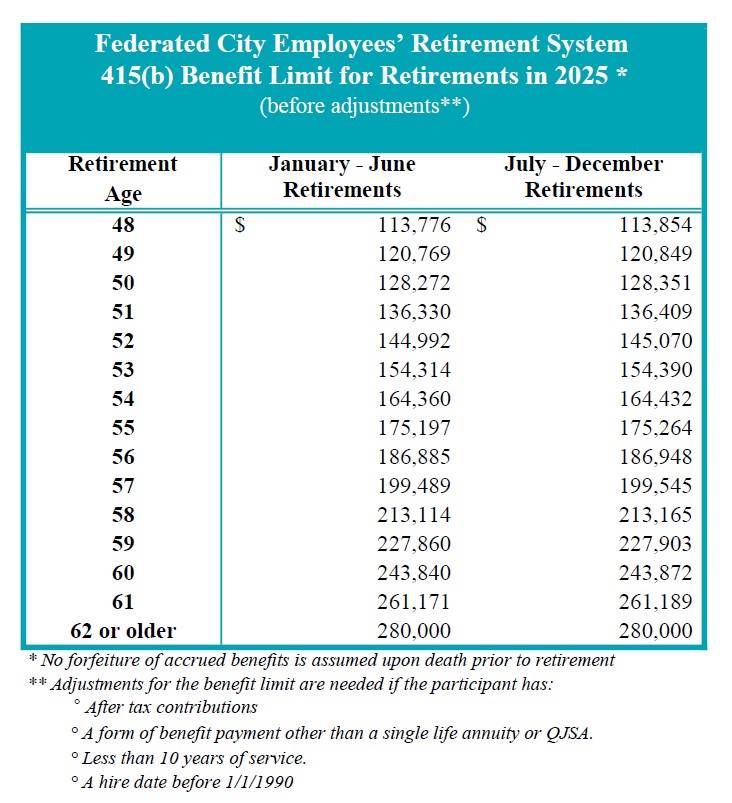

IRC 415(b) Benefit Limits

IRC 415(b) limits the amount of retirement benefits that you may receive under a qualified retirement plan, such as the Federated City Employee Retirement System (FCERS) and Police and Fire Departments Retirement Plan (PF), even if you have not exceeded the section 401(a)(17) compensation limitation.

The IRC 415(b) benefit limit varies a great deal based on your age at retirement, the date you became a FCERS or PF Plan member, post-tax employee contributions made by you, and the retirement option you choose.

The IRC 415(b) dollar limit on benefit payments is adjusted periodically based on the Consumer Price Index. If your retirement benefit is affected by IRC 415(b), the FCERS and PF Plan will notify you by the end of March (Police & Fire) or April (Federated) of the year that you’re impacted.

IRC 415(b) Fact Sheet

Benefit Limit Table 2025 by month.pdf

Please contact the Office of Retirement Services for more information.

* No forfeiture of accrued benefits is assumed upon death prior to retirement ** Adjustments for the benefit limit are needed if the participant has:

° After tax contributions

° A form of benefit payment other than a single life annuity or QJSA. ° Less than 10 years of service. ° A hire date before 1/1/1990

Note: members with 15 years of qualified full-time Police or Fire employment are exempt from the reduction for age at retirement.